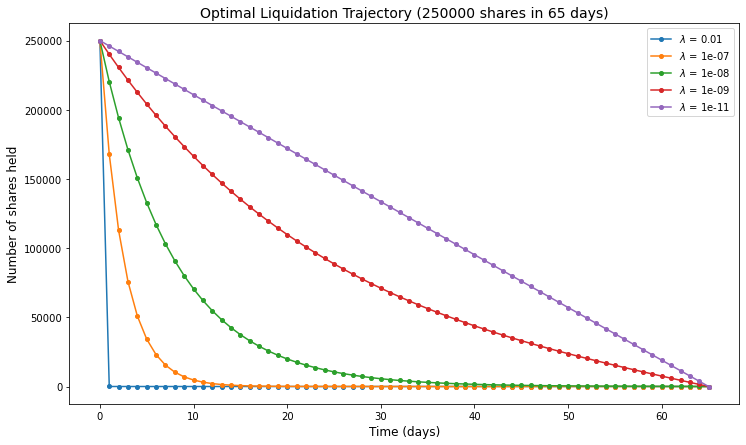

The aim of the Almgren-Chriss optimal execution model is to minimize a combination of volatility risk and transaction costs arising from permanent and temporary market impact. In this notebook, we study the model for liquidation of large positions with real financial data.

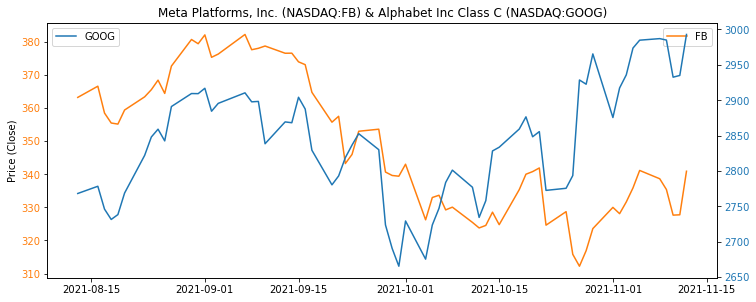

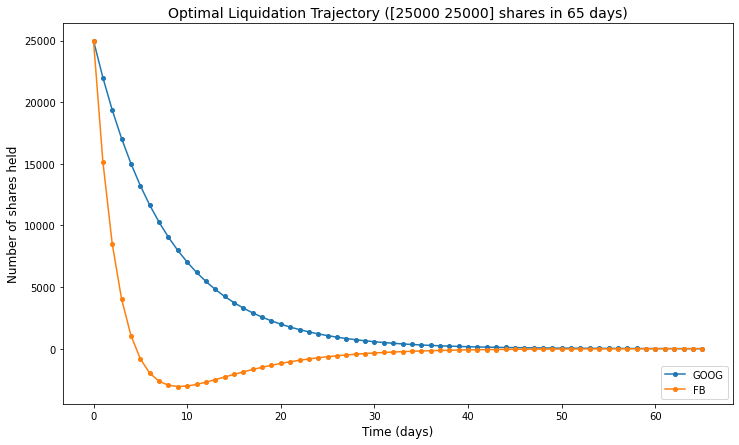

We numerically illustrate the model with financial data for two correlated assets. In particular, we use the daily historical prices of Alphabet Inc. (NASDAQ:GOOG) and Meta Platforms, Inc. (NASDAQ:FB) over three months.

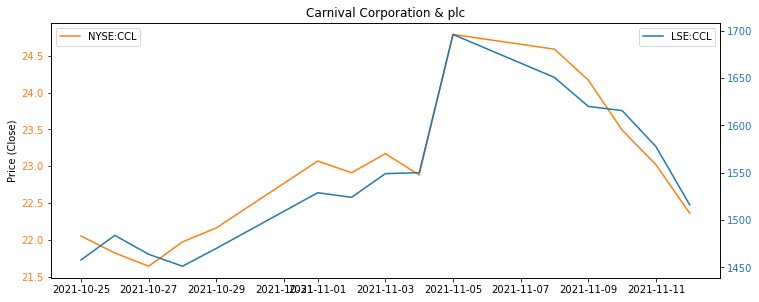

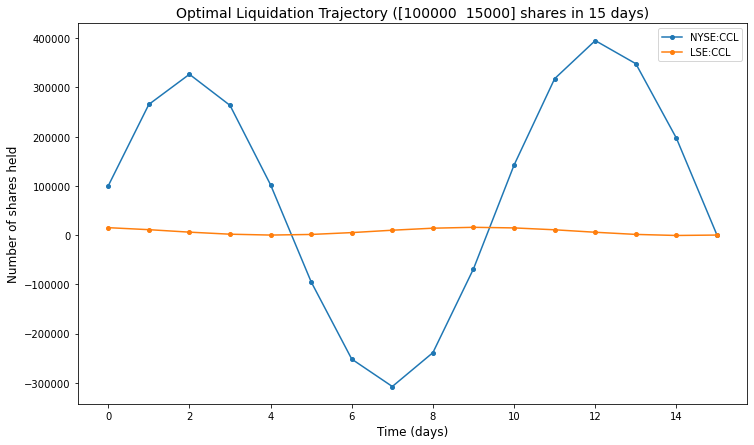

We explore a particular case of trading shares of the same company on different exchanges. In particular, we explore the optimal strategy for closing a position of Carnival Corporation & plc (CCL) over 15 days. CCL is a British-American cruise operator which is currently the world's largest travel leisure company. Shares of CCL are traded on both the NYSE and the LSE. See Jupyter notebook for more details.